Part 1: A breakdown of Etsy’s complicated fee structure, with examples

It’s hard for sellers to profitably price their handmade wares with Etsy’s unnecessarily opaque and complex fees. In this series of posts, we break all the fees down, offer tips for pricing products to accommodate changing fees, and compare Etsy’s fees to some “Etsy alternatives”.

First, the breakdown: Etsy’s Seller Handbook lists 12 different kinds of fees (and that doesn’t include policies with financial costs, like free shipping). Some of the fees are mandatory for any shop doing business, some fees are mandatory for only certain shops, and some fees are optional.

The bottom line? Actual fees on a sale could be anywhere from 10% to 40%, depending on the value of the sale, how long an item has been on the marketplace, the location of the seller and buyer, and the role of the ever-important Offsite Ads program.

List of Etsy Fees

Mandatory Fees for All Shops

- Listing Fee: $0.20USD flat fee for each item when listed for sale, valid for 4 months (charged whether or not the item sells)

- Listing Renewal Fee: $0.20 USD per listing every 4 months until deactivated or sold

- Transaction Fee: 6.5% is charged on the total amount of the sale, less taxes for sellers in the US and Canada. The 6.5% fee is charged on taxes for sellers in other countries.

- Payment Processing Fee: 3% is charged on the total amount of the sale, including taxes and shipping. This is basically the cost of accepting credit cards and payment methods like PayPal. It is a fairly standard fee no matter what marketplace or website hosting service you use.

Mandatory Fees for Some Shops

- Offsite Ads: Mandatory for all sellers who have ever sold over $10,000 USD in one year, even if they later earn less than $10k/year going forward. Shops over $10k are charged 12%, shops under $10k who don’t proactively opt out are charged 15%. The 15% is charged on sales “attributed” to Etsy marketing within the last 30 days:

- Not including taxes in US/CA

- Including taxes for other sellers

- Regulatory Operating Fee: For sellers in certain countries (as of this writing: UK, France, Italy, Spain, Turkey). Fee varies by country, currently ranges from 0.25% – 1.1% on the sale amount, including taxes (current list).

Optional Fee Programs

Additional fees apply for other voluntary programs:

- Etsy Ads: on-site search advertising, sellers set a daily budget

- Etsy Plus: $10/month subscription for a package of storefront customizations, pre-paid fees, and perks from advertising partners.

- Currency Conversion: 2.5% on sale amount if products are listed in a different currency than the shop location

- Pattern: $15/month for Pattern websites

- Shipping Fees: shipping cost (including a mark-up for Etsy) for Etsy-provided shipping labels and insurance. (Shipping can be purchased elsewhere, such as shipping consolidators like ShipStation or ShipEasy, or directly through carriers like the USPS or FedEx.)

Examples: How Fees Can Vary Per Sale

Let’s take all that fee information above and look at a couple hypothetical sales to understand the magnitude of how much the actual fees can vary. Here’s the formula for applying fees to a sale:

Sale Fees = (Sale Amount [sale price of products, shipping, and gift wrap + tax, if applicable] x Rate(s)) + Flat Fee(s)

Comparison of Maximum Fees: $100 Sale vs $10 Sale

Let’s compare the maximum fees for two hypothetical sales from the same shop: one for $100 and one for $10. In our hypothetical, this seller ships to and from the United States in a state with a 5% sales tax, and sales resulted from the buyer clicking on an Offsite Ad even though the seller earns under $10k/year.

Because the flat fees hurt sellers of low-priced items, the total maximum fee is between 25% and 32%:

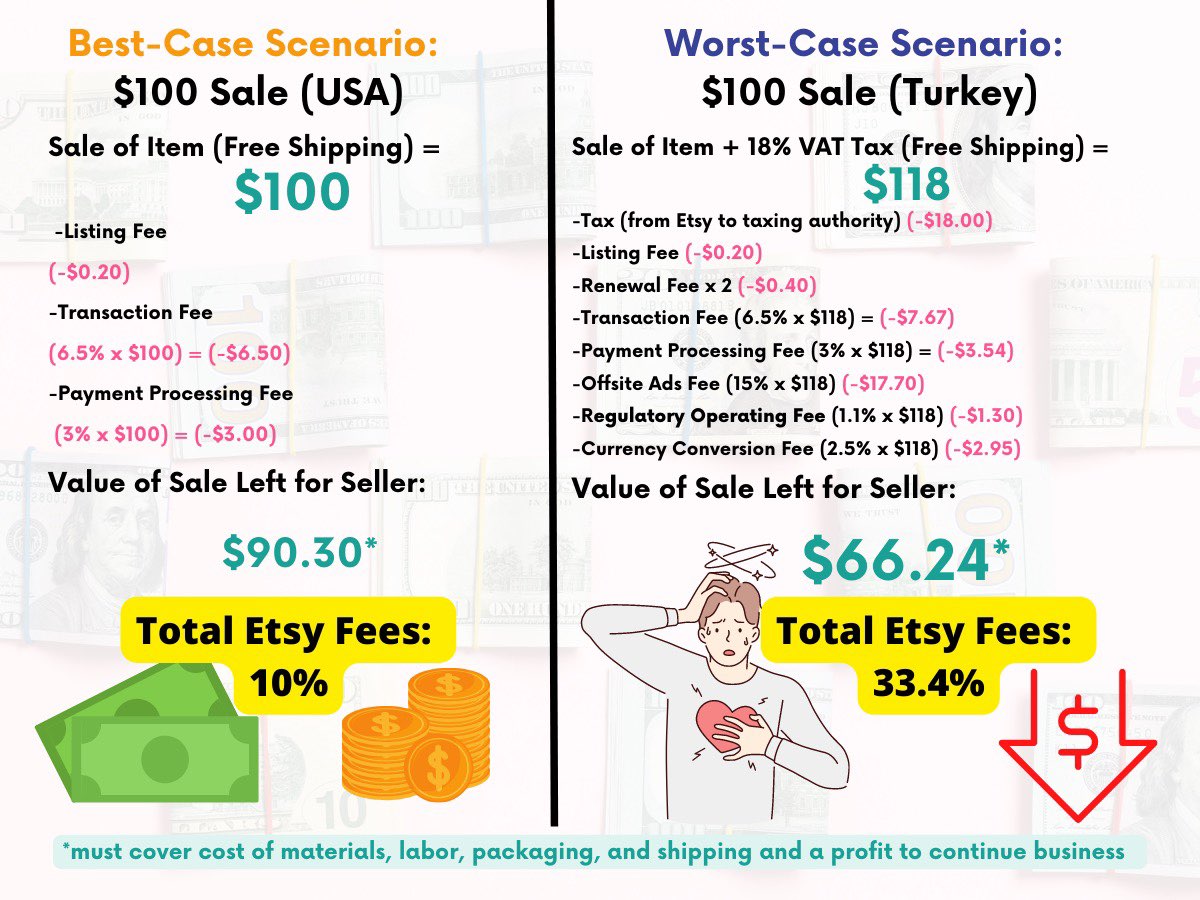

Comparison of Worst-Case to Best-Case Fees on a Hypothetical $100 Sale

On the other hand, not all sales result from Offsite Ads, which makes a big difference in the bottom line. When it launched the program, Etsy told sellers that they estimated 10% of sales would result from an Offsite Ad, and in practice, I have found this to be true. And where sellers reside makes a big difference.

In this case study, we look at two very different $100 sales.

In our best-case hypothetical, the US-based seller ships from and to a state without a sales tax like Oregon, the sale was not initiated by Offsite Ads, and the item was a one-of-a-kind item that sold within 4 months and hence had no renewal fee.

In our worst-case hypothetical, the Turkey-based seller has Regulatory Operating Fees, an 18% VAT tax, sells in US dollars instead of Turkish lira, had the item listed for 5 months before selling, and got the sale from an Offsite Ad, even though the seller makes under $10k.

The resulting fees for a $100 sale vary from 10% to 33.4%. If the worst-case scenario in Turkey were a low-value $10 sale, the fees would be a whopping 39.5%.

Now that we’ve broken down what all the fees are, in the next post we’ll talk about how sellers should use this information in pricing their products.

[…] from Etsy—possibly the biggest one—came in the form of their rising, increasingly confusing fees. Artisans Coop boasts a simple fee structure: a percent of the price as sale commission to the […]